TL;DR: Regulations in finance are not just red tape, they protect SMEs, ensure fair lending practices, boost trust in lenders, and safeguard economic stability. For platforms like CredibleX, operating under ADGM’s regulatory framework, compliance ensures transparency, credibility, and confidence for SME clients.

The Role of Regulation in Finance

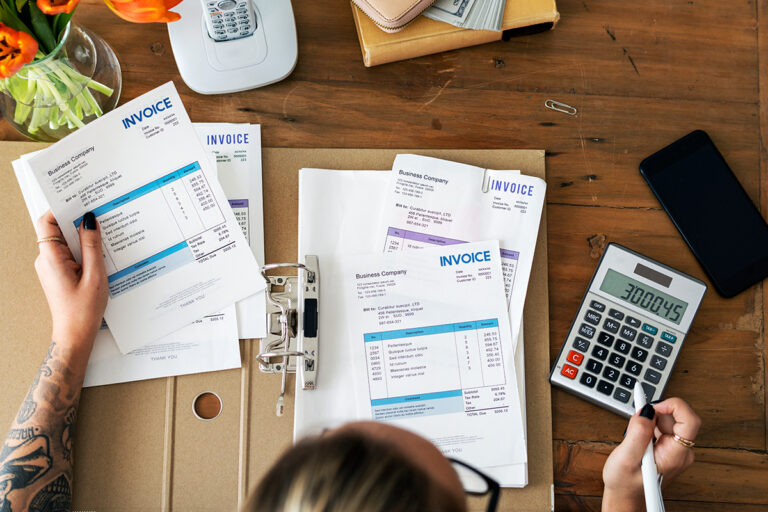

In the fast-paced world of lending and fintech, regulation plays a crucial role in protecting customers and ensuring trust in financial institutions. While some businesses may view it as a barrier, regulation actually provides the foundation for fair, transparent, and sustainable financing.

Why Regulation Matters for SMEs

1. Protecting Customers

Regulations ensure lenders disclose key details upfront:

- Interest rates

- Fees

- Repayment schedules

This transparency protects SMEs from hidden charges or predatory practices and allows them to make informed financing decisions.

2. Enhancing Lender Credibility

When lenders operate under clear regulatory frameworks, it strengthens trust with SMEs, investors, and ecosystem partners. Credibility is vital in lending, businesses want assurance their financing provider is compliant, responsible, and trustworthy.

3. Supporting Economic Stability

Strong regulations prevent excessive risk-taking by ensuring lenders maintain robust risk management practices. This reduces the likelihood of financial crises, ultimately protecting SMEs and the broader economy.

4. Encouraging Responsible Innovation

Balanced regulation encourages innovation while ensuring responsible practices. For SMEs, this means access to modern financing options like Revenue-Based Financing, Invoice Discounting, and Payable Financing , delivered responsibly and transparently.

CredibleX and Regulatory Compliance

At CredibleX, compliance is part of our DNA. As a licensed lender under ADGM, we operate under strict guidelines that ensure:

- 100% transparency in all financing agreements

- Fair and responsible lending practices

- Digital processes that combine innovation with regulatory oversight

This balance allows us to deliver fast, flexible financing to SMEs while maintaining credibility and trust.

Final Thoughts

Regulation is not about slowing down SMEs – it’s about creating a safer, more transparent, and more credible financial ecosystem. For SMEs in the UAE, choosing a financing partner that is licensed and compliant ensures peace of mind, better protection, and long-term growth.

Looking for secure, transparent, and fast SME financing?

Apply now with CredibleX and experience financing backed by trust and regulation.

Frequently Asked Questions (FAQ)

1. Why is regulation important in SME financing?

It protects SMEs from unfair practices, ensures transparency, and builds trust in lenders.

2. How does regulation affect fintech lenders like CredibleX?

It ensures lenders operate fairly, disclose terms clearly, and maintain robust risk management.

3. Can regulation slow down innovation?

Poorly designed regulation can, but balanced frameworks encourage innovation while ensuring SME protection.

4. Is CredibleX regulated?

Yes. CredibleX is a licensed lender under ADGM, operating with full compliance to UAE regulations.